Directors banned for “appalling exploitation” of care home investors

Two directors have been banned for 25 years after abusing millions of pounds of investors’ funds in a care home investment scheme.

Christopher Bateman (49) and his business partner, Nicola Fairweather (48) were investigated by the Insolvency Service after their Cheshire businesses GCC Management Ltd and Amek Solutions Ltd went into insolvency.

Robert Clarke, chief investigator for the Insolvency Service, said: “Our thorough investigations uncovered extensive abuse of investors who have lost millions of pounds through Bateman and Fairweather’s deceitful activities. Many investors were regular people who were not familiar with investments and were duped to transfer money from their hard-earned pensions.

“The judge commented in court that this was an appalling exploitation of relatively unsophisticated investors. Thankfully Bateman and Fairweather have been removed from the corporate arena for a significant amount of time and this should send a clear message to other company directors that there are serious consequences if you dupe those seeking to invest pension funds to best effect.”

GCC Management was an unregulated company that offered people the opportunity to invest in the purchase of care homes, with the promise of fixed rate returns of 10% to 30%. Amek Solutions advised on and/or arranged investments in GCC Management.

Investigators found Bateman caused Amek Solutions to breach the Financial Services and Markets Act 2000 by advising people – many being unsophisticated investors – to transfer funds from their pensions; failing to advise investors to seek independent financial advice; and not having the authority to encourage investments.

Amek Solutions promoted GCC Management’s scheme to at least 133 people, who invested close to £6.3 million from their pensions despite not being protected under the Financial Services Compensation Scheme. Amek Solutions was rewarded by receiving more than £5.4 million in commission from GCC Management.

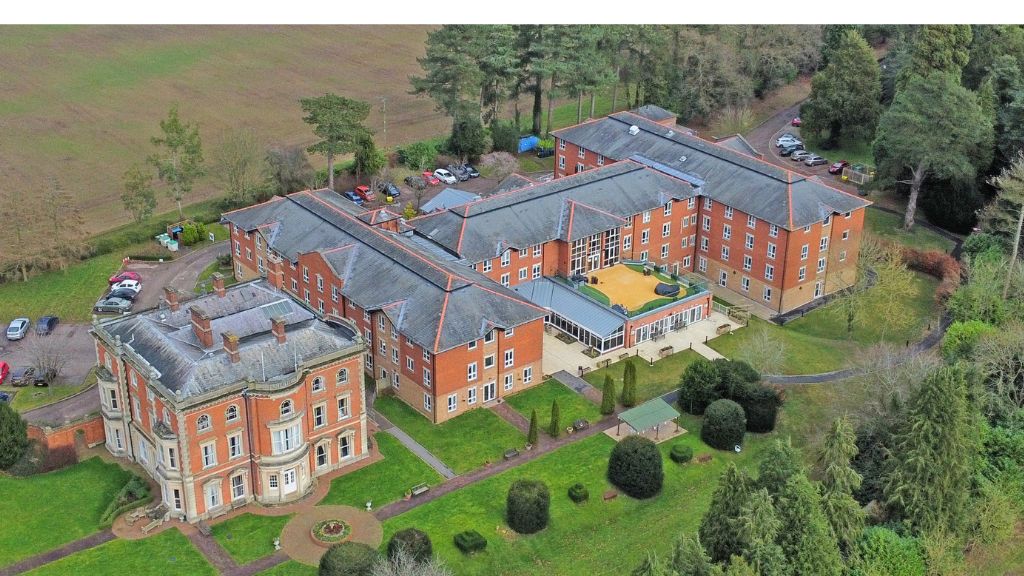

When GCC Management, which only had one operational care home, entered into liquidation investors were owed £13.2 million.

Investigators calculated that at least 243 people invested more than £11.6 million with GCC Management. 166 of these investors transferred more than £7.8 million from their existing pensions.

The investigation found GCC Management made unaccounted payments worth millions that did not benefit the company or its investors. This included £1.4 million paid to connected companies Bateman and Fairweather were directors of and another £1.4 million to foreign exchange companies.